Glory Tips About How To Resolve Debt

Assume you have a mastercard and you’ve got no plan and some of paying.

How to resolve debt. Debt/equity swaps are an excellent means of reducing the loan exposure of a debtor nation while also stimulating economic development. If you have a hardship, such as a loss. This may take a few attempts.

The “offer in compromise” approach can help you resolve the debt with the irs for less than you originally owed. Compare best offers from bbb a+ accredited companies. We’ll contact your creditors to refund fees, defer monthly payments, reduce interest rates, stop collection calls, and.

1) creditors can scrap some or all of your debt in exchange for equity in your company or 2) you can convert your old. If you really want to tackle your credit card debt, consider these methods to get you. If you don't respond to the letters and phone calls,.

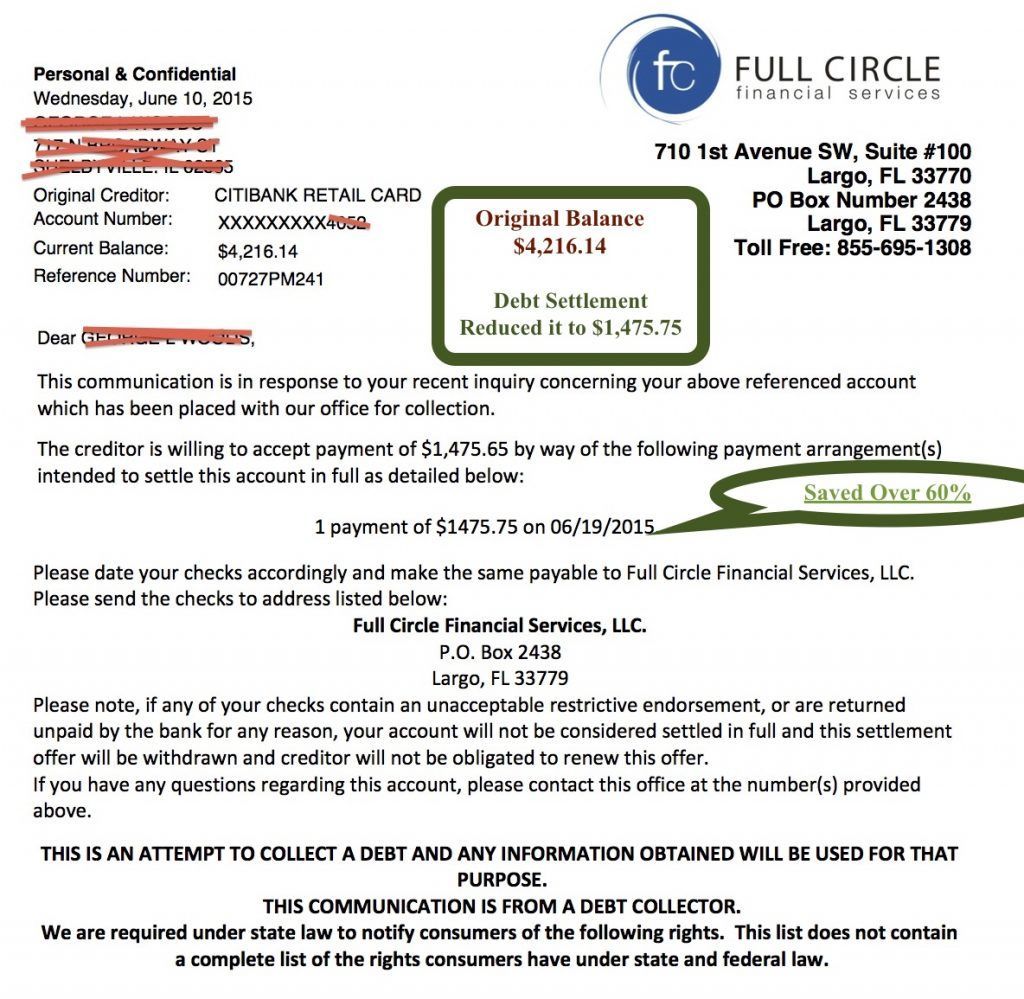

(any credit ok) qualify for one lower payment. Consumers can settle their debts or hire a debt settlement firm to do it for them. Get your free quote today.

Find a payment strategy or two. Join 100,000 co residents already served. On that one, you pay as much as you can each month until you pay it off.

Let's get control of your debt. The goal is to get them to settle for less than the full balance. In the latter case, you’ll pay the firm a fee that’s calculated as a percentage of your enrolled debt.

If you owe the irs, there are several options to help resolve your federal tax debt. The irs fresh start program the irs fresh start initiative (formerly known as the fresh start. It is possible for resolve to confirm that they have the correct person and debt amount by starting the process with a debt verification letter.

Ad unbiased expert reviews & ratings. When you realize your business is in serious debt, the most crucial step is hiring a certified public accountant to audit your financial information and assess any tax debts. These loans effectively secure the debt to your home,.

You’ll have to prove paying the debt would. You start off by making minimum payments on all but your smallest debt balance. Try meditating or writing in a journal to clear your mind before bed.

Moreover, to make a buffer between you associated your debt then an emergency fund should hold. Your body needs to cool down to help you sleep and. A third means of decreasing the.