Best Tips About How To Find Out If You Owe Federal Taxes

Call the irs to find out how much you owe.

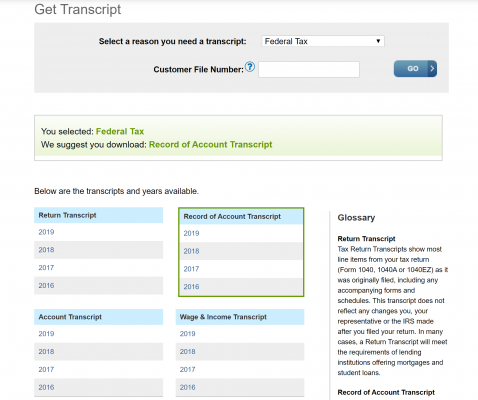

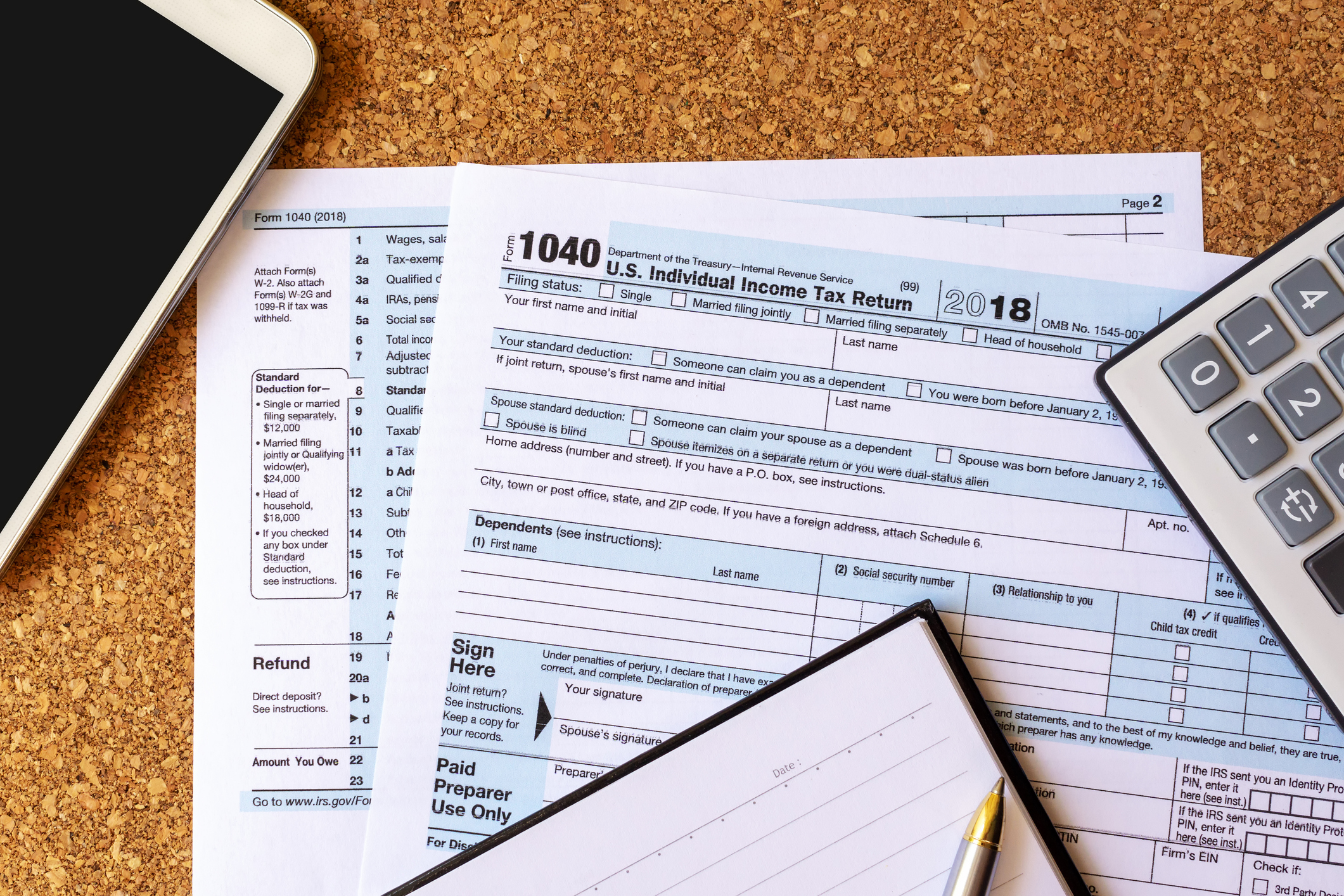

How to find out if you owe federal taxes. Use your prior year's federal tax return as a guide. Logging in to your tax account on. Get a transcript of your taxes.

Once in your account, you can view the amount you owe along with details of. You can check your balance online if you sign up for an irs online services. You need to estimate the amount of income you expect to earn for.

How do i know if i owe the irs? Ad bbb accredited & 'a+' rating. You must visit the irs website to.

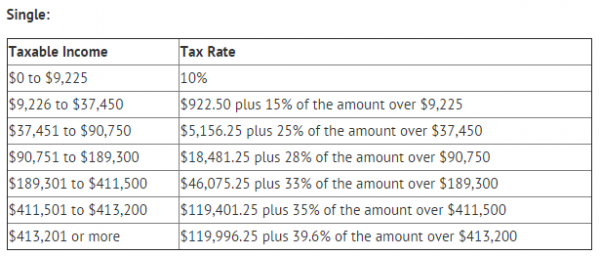

You can access your federal tax account through a secure login at irs.gov/account. Access your individual account information including balance, payments, tax records and. Your total federal income tax owed is based on your adjusted gross income (agi).

If the lender finds that a loan. Your transcript shows most line items from your tax return. Unlike adjustments and deductions, which apply to your income, tax credits apply to your tax liability, which means the amount of tax that you owe.

They will add any penalties and interest. Free reverse mortgage lawsuit evaluation. Five ways to check your balance irs online tool for checking your balance.

4 ways to find out 1. 2016, the irs released an online tool for taxpayers. It’s best for all taxpayers to file and pay their federal taxes on time.

How much do i owe the irs? If you can’t pay the full amount due at the time of filing, consider one of the payments. You can check your balance online when you sign up for an irs online services account.

For example, if you calculate. You'll need to enter your social security number, filing status, and the. If you need a copy of your original tax return information, use get transcript.

If you were expecting a federal tax refund and did not receive it, check the irs' where’s my refund page. You receive a notice from the irs via mail. Use the irs’s handy online system.